Test page

- Hits: 168

Written by Super User on . Posted in Section A.

STATEMENT OF MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL REPORTING

The consolidated and separate financial statements of the Group’s and the Bank’s operations in Mauritius presented in this annual report have been prepared by management, which is responsible for their integrity, consistency, objectivity and reliability. International Financial Reporting Standards of the International Accounting Standards Board as well as the requirements of The Companies Act 2001 of Mauritius, The Banking Act 2004 (amended August 2020) and the guidelines issued by the Bank of Mauritius, have been applied in the preparation and fair presentation of the financial statements for the year ended 30 June 2020 and management has exercised its judgement and made best estimates where deemed necessary.

The Group and the Bank have designed and maintained its accounting systems, related internal controls and supporting procedures, to provide reasonable assurance that financial records are complete and accurate and that assets are safeguarded against loss from unauthorised use or disposal. These supporting procedures include careful selection and training of qualified staff, the implementation of organisation and governance structures providing a well-defined division of responsibilities, authorisation levels and accountability for performance and communication of the Bank’s policies, procedure manuals and guidelines of the Bank of Mauritius throughout the Bank.

The Bank’s Board of Directors, acting in part through the Audit Committee, Conduct Review Committee, Corporate Governance Committee, Credit Committee, Risk Management Committee and Technology, Digitalization and Platforms Committee, which comprise executive, non-executive and independent directors, oversee management’s responsibility for financial reporting, internal controls, assessment and control of major risk areas, and assessment of significant and related party transactions.

The Bank’s Internal Auditors, who has full and free access to the Audit Committee, conduct a well-designed program of internal audits. In addition, the Bank’s compliance function maintains policies, procedures and programs directed at ensuring compliance with regulatory requirements.

Pursuant to the provisions of The Banking Act 2004 (amended August 2020), the Bank of Mauritius makes such examination and inquiry into the operations and affairs of the Bank as it deems necessary.

The Bank’s external auditors, Deloitte, have full and free access to the Board of Directors and its committees to discuss the audit and matters arising therefrom, such as their observations on the fairness of financial reporting and the adequacy of internal controls.

INDERJIT SINGH BEDI

Interim Chairperson

SANJIV BHASIN

Chief Executive Officer

JOAN JILL WAN BOK NALE

Director

Read more: STATEMENT OF MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL REPORTING

Written by Super User on . Posted in Section A.

Foreword

While the health crisis we are confronted with supersedes all other topics in this year’s annual report, the core principle of value creation during the economic disruption as we deal with the spiraling effects of this pandemic remains of top priority in the Bank’s agenda. We have vowed to keep clients at the absolute center of everything we do as we go all out in delivering tailored services, adapted advice and consequential capital to path our clients towards success and their ultimate well-being.

BUSINESS SEGMENTS REVIEW

Major Business Segment’s Achievements

Treasury and Markets’ gross operating income grew by 9% year-on-year, spearheaded by a record performance on the Trading Income side. Trading Income finished in excess of MUR 1.2bn, showcasing a year on year growth of 35%. We saw solid performance on both the FX side and the Money Markets/Fixed Income side of the business, supported by our Structuring desk. Indeed, the bank closed a landmark deal being the first ever USD/MUR Cross Currency Interest Rate Swap (“CCIRS”) in the Mauritian market. Given a sudden reversal in market interest rates, the Treasury and Markets team was also able to position the balance sheet so as to limit the adverse impact of the reduction in interest rates - further shoring up Net Interest Income performance for the bank. The Treasury and Markets team also closed the IBL Bond Issuance mandate for a total amount of MUR 4bn.

Our Strategy

Below is our proposition by unit:

The four key pillars within the Treasury and Markets cluster are Treasury, Financial Institutions, Custody and Securities Services and Debt Capital Markets. Our goal is to ensure that our client facing and support functions are aligned to consistently provide our clients with best in class services. Treasury and Markets’ prerogative is to provide clients with tailored solutions by reinforcing ABL’s position as the market makers for foreign exchange, interest rate, debt, and other structured derivatives. ABL further consolidates its stance as an innovative Financial Markets service provider catering not only to Mauritian demands but also effectively meeting financial requirements in the regional sphere.

Its local expertise, global access and balance sheet scale allows the Bank to provide clients with a range of financial instruments to meet their risk management, investment and trading needs. Managed by a team of professionals with decades of experience, Treasury and Markets is committed to satisfy its clients’ commercial and investment needs.

The Core Ideas

WE AIM TO FOSTER A “TRADING CULTURE” IRRESPECTIVE OF ASSET CLASS, BY INCREASING THE NUMBER OF IN-HOUSE TRADERS. UP-SKILLING OF OUR HUMAN CAPITAL AND RESEARCH IS AT CORE OF THIS STRATEGY, DRIVING ECONOMIES OF SCALE IN THE LONG RUN.

A FLEXIBLE AND NIMBLE APPROACH TO RISK MANAGEMENT AND A CONSTANT DIVERSIFICATION STRATEGY, ENABLING THE BANK TO FULLY EMBRACE THE CHALLENGES BROUGHT UPON BY THE COVID-19 PANDEMIC.

EMBARKING ON THE DIGITALISATION JOURNEY OF OUR CUSTODY & SECURITIES SOLUTIONS PLATFORM. WE EXPECT ROLL-OUT OF THE PLATFORM IN FY 21.

The Future

The future is riddled with uncertainty. Other than a global recession, the COVID-19 pandemic has created significant turmoil in global markets whereby we are expecting to see increased volatility in financial markets for the foreseeable future. The severe contraction of the local economy coupled with potential EU sanctions on the Mauritian jurisdiction, will also present another set of challenges for the banking sector. Given the increasingly challenging landscape, our focus shall be on shoring up risk taking by adopting a “Risk and Capital” preservation strategy, as prescribed by our Board. We nevertheless remain ready to support our stakeholders and will keep abreast of market developments, so as to identify the right opportunities.

On 1 September 2020, of the 25,298,875 cases reported globally so far, 53% are in Americas. This is followed by Europe and South East Asia with 4.2m cases respectively. The number of deaths stood at 847,602 which were mainly caused by community transmission.

Coronavirus has already impacting global markets, with economic impacts felt beyond China and other effected countries. Stock indices tumbled, spooked by reports that the coronavirus outbreak that emerged in China is spreading to countries including Italy, Iran and South Korea. Trading in stocks across world markets remained choppy, reflecting hope that the economic fallout might be manageable. The markets’ movements mirror the uncertainty that prevails and persists not just in the U.S. but all over the world. Several weeks into the coronavirus outbreak that has brought the world’s second-largest economy to its knees, some of the most basic aspects of the virus remain unknown.

In its June 2020 report, the IMF projected that the global growth will shrink to –4.9% in 2020, as compared to 2.9% in 2019. The COVID-19 pandemic has had a negative impact on activity in the first half of 2020, and the recovery speed is uncertain.

However, it is important to acknowledge that the global economy was already facing some difficulties prior to the COVID-19 pandemic.

Since 2019, there was a perceived sentiment that a recession might be underway. The global 2019 growth rate was forecast to be 3.2%1 , but the actual rate was 0.3% lower. In addition, there were escalating tensions between the United States of America and China on multiple fronts and widespread social unrest posed challenges to the global economy. Due to the slowdown of several economies, central banks across the globe began to reduce interest rate to stimulate consumption and investment. For example, the 3-months USD Libor decreased from 2.26% to 0.31% in one year (as shown below).

1 https://www.imf.org/en/Publications/WEO/Issues/2019/07/18/WEOupdateJuly2019

With the emergence of the COVID-19 pandemic and as a result, many countries went into lockdown, global activities came to a near standstill. This has induced an economic recession worldwide. The synchronized nature of the downturn has amplified domestic disruptions around the globe. Trade contracted by close to –3.5 percent (year over year) in the first quarter of the calendar year. This reflects the weak demand, the collapse in cross-border tourism, and supply dislocations related to shutdowns (exacerbated in some cases by trade restrictions).

https://www.imf.org/en/Publications/WEO/Issues/2019/07/18/WEOupdateJuly2019

In most recessions, consumers dig into their savings or rely on social safety nets and family support to smooth spending, and consumption is affected relatively less than investment. But this time, consumption and services output have also dropped markedly. This is due to lockdowns needed to slow transmission of the disease, steep income losses, and a general weaker consumer confidence. Firms have also cut back on investment when faced with precipitous demand declines, supply interruptions, and uncertain future earnings prospects. Thus, there is a broad-based aggregate demand shock, compounding near-term supply disruptions due to lockdowns.

Hence, this pandemic required a high level of state intervention that the world hasn’t even seen in wartime. Governments worldwide implemented several support and relief measures coupled with regulatory forbearance measures to assist their economic operators. There have been numerous fiscal measures to support ailing business, the self-employed and employees who have been (partly) laid off because of the virus. For instance, the United States of America support package was equal to 12% of its GDP.

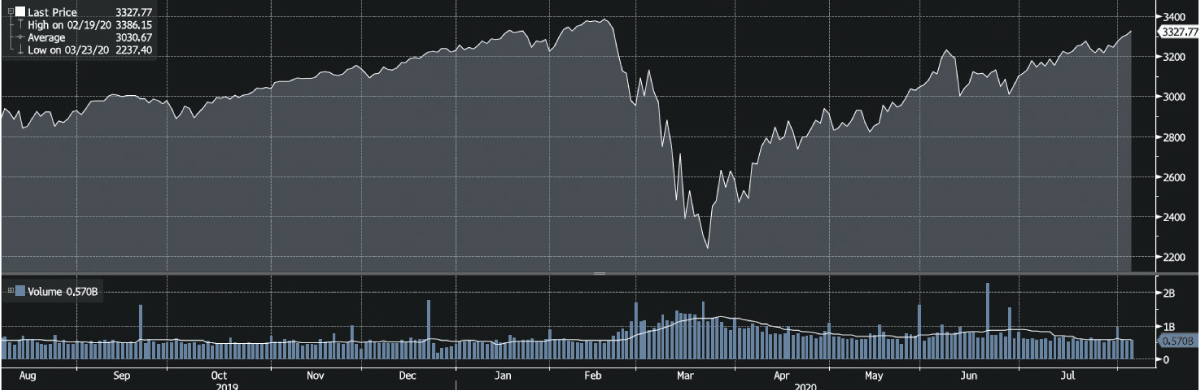

The Financial Markets

Due to the liquidity concerns and the general uncertainty about the magnitude of the crisis, equity markets plunged at the beginning of the crisis (Refer to graph below). However, the recent rebound in financial market appears to be ahead of the economic prospects. Yet, the environment remains volatile and uncertain.

The Ongoing Health concern

COVID-19 continues to impact several countries and medical breakthroughs with therapeutics and changes in social distancing behavior might allow health care systems to cope better without requiring extended, stringent lockdowns. Vaccine trials are also proceeding at a rapid pace. Development of a safe, effective vaccine would lift sentiment and could improve growth outcomes in 2021.

Beyond the pandemic, policymakers must cooperate to resolve trade and technology tensions that endanger an eventual recovery from the COVID-19 crisis.

Outlook

The COVID-19 pandemic started as a sanitary crisis but soon became a global multidimensional crisis. Global economies have been badly hit including Mauritius. The IMF forecasted the Mauritian economy to contract to -7% for 2020 . Even though Mauritius has a diversified economy , it nevertheless remains vulnerable to global economic trends. Due to the lockdown and closure of our borders, many of our sectors like the tourism, manufacturing and trade industries have been badly impacted.

However, over the past few months, we have seen substantial support from the Government of Mauritius and the Bank of Mauritius (as shown below). The government has used fiscal stimulus and eased monetary policies in order to support our economic operators during this unprecedented time. Through the Government support measures, we have observed the prevention of large-scale bankruptcies in the economy. The setting up of the Mauritius Investment Corporation Ltd (“MIC”) by the Bank of Mauritius further complements the Bank’s Support Program. The main objectives of the MIC are to support employment, investment and exports.

| Year | Period Description | Mauritius GDP Growth |

|---|---|---|

| 2008 | Pre-Financial Crisis | 5.40% |

| 2009 | Financial Crisis Impact | 3.30% |

| 2019 | Pre COVID-19 | 3.60% |

| 2020 4 | COVID-19 Impact | -6.80% |

SUPPORT PROGRAMME

| TOURISM/MANUFACTURING: | MUR 3bn |

| AGRICULTURE: MUR 1bn and SMEs: | MUR 1bn |

The ratio for MUR was reduced from 9% to 8%.

A moratorium of 9 months on capital should be granted for deferral requests or extension of existing facilities.

BOM put on hold the Guideline on Credit Impairment Measurement and Income Recognition.

BOM set out some guiding principles when classifying for Stage 2 and Stage 3 in a COVID-19 context.

MUR 60bn for Economic Stabilization

USD 2bn at the disposal of the MIC to support economic operators with min. turnover of MUR 100m.

As countries have tightened their border controls, this pandemic has forced us to rethink the sustainability of an export-led economy. In the Budget 2020/21, we have noted that the Government has encouraged local production, diversified into strategic sectors like the Blue economy and pharmaceuticals as well as promote sustainable development 5. Even though Mauritius has been able to contain the impact of the COVID-19 pandemic, there are still some perceived risks looming for the FY21.

5 PwC Budget Brief 2020

Uncertain Outlook

The Governor stated in a press conference on the 8th of July 2020 that the forbearance period was extended for another 3 months, resulting in a total moratorium period of 9 months 6 . This extension was welcomed by many economic operators, especially those in the tourism sector. Nevertheless, it will now be difficult to assess the financial stability of economic operators post the moratorium period and Government Support Programme. There should be continuous assessments to determine whether some economic operators have experienced permanent damages.

On 7th May 2020, the European Union (“EU”) proposed a number of third countries to their list of countries which money laundering and terrorist financing deficiencies pose a significant threat to the financial system of the EU. The FATF’s report highlighted AML/ CFT deficiencies in Mauritius related to DNFBPs (Designated Non-Financial Businesses and Professions), i.e., lawyers, notaries, estate agents, accounting firms etc. and NOT banks. On the contrary, the report highlighted that most banks applied standards which went over and above regulatory requirements.

Currently, Mauritius is largely compliant with 35 out of the 40 recommendations and it has already met the FATF expectations in respect of the ‘Big Six Recommendations’. Mauritius is addressing the FATF concerns actively in order to be removed from the FATF grey list (and consequently the EU list) as quickly as possible.

The EU blacklist took effect as from the 1st October 2020.

The closure of borders has brought the tourism sector to a standstill. The recovery of this sector will be slow due to the fear of COVID-19 contamination among citizens and global travel restrictions.

We also need to keep in mind that restrictions might remain in place for longer than we expect if there is the re-emergence of the virus “second-wave”. Travelling quarantine policies have been set up for tourists and Mauritians entering the country but the impact of these policies on our tourism sector is yet to be determined.

Gradual Recovery in 2021

In the Budget 2020/21, the government aims to stimulate the economy through government spending by investing in major infrastructure in order to offset the negative effects of COVID-19 outbreak . Mauritius can expect a gradual recovery in 2021. Some sectors will recover more rapidly e.g. construction sector while others will have a more prolonged recovery phase e.g. the tourism industry.

6 MPC speech; 8th July 2020: https://www.bom.mu/media/speeches/mpc-meeting-press-statement-governor

7 Fitch Solutions: Mauritius Country Risk Report Q3 2020, Page 13

8 Fitch Solutions: Mauritius Country Risk Report Q3 2020, Page 12

The unanticipated COVID-19 virus has created much havoc, not only in our personal lives but also on the financial standing of the corporate world including the banking sector. Despite this unparalleled situation, the Bank ensured that it maintained the delivery of services to clients on the back of fast-tracked roll-outs of digital applications.

| AFRASIA BANK LIMITED | 30 JUNE 2018 | 30 JUNE 2019 | 30 JUNE 2020 |

|---|---|---|---|

| STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME (MUR'm) |

|||

| Net interest income, calculated using EIR method | 1,710 | 2,311 | 2,028 |

| Non-interest income | 1,193 | 1,382 | 1,787 |

| Total operating income | 2,903 | 3,693 | 3,815 |

| Total operating expenses | 927 | 1,109 | 1,275 |

| Profit after tax after OCI | 766 | 1,579 | 1,502 |

| STATEMENT OF FINANCIAL POSITION (MUR'm) | |||

| Total assets | 120,400 | 139,873 | 160,473 |

| Loans and advances to banks and customers | 28,066 | 28,169 | 28,290 |

| Deposits from banks and customers | 111,385 | 131,208 | 150,947 |

| Total equity (including Class A shares) | 6,899 | 7,716 | 8,641 |

| PERFORMANCE RATIOS (%) | |||

| Return on average equity | 14 | 25 | 21 |

| Return on average assets | 0.7 | 1.2 | 1.0 |

| Loans-to-deposits ratio | 25 | 21 | 19 |

| Cost-to-income ratio | 32 | 30 | 33 |

| CAPITAL ADEQUACY RATIO (%) | |||

| Capital Management | 14.71 | 15.85 | 15.15 |

| AFRASIA BANK LIMITED AND ITS SUBSIDIARIES | 30 JUNE 2018 | 30 JUNE 2019 | 30 JUNE 2020 |

|---|---|---|---|

| STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME (MUR'm) |

|||

| Net interest income, calculated using EIR method | 1,706 | 2,311 | 2,028 |

| Non-interest income | 1,277 | 1,417 | 1,822 |

| Total operating income | 2,983 | 3,728 | 3,850 |

| Total operating expenses | 994 | 1,200 | 1,320 |

| Profit after tax after OCI | 763 | 1,627 | 1,528 |

| STATEMENT OF FINANCIAL POSITION (MUR'm) | |||

| Total assets | 121,961 | 141,361 | 160,477 |

| Loans and advances to banks and customers | 28,066 | 28,169 | 28,290 |

| Deposits from banks and customers | 111,136 | 131,033 | 150,922 |

| Total equity (including Class A shares) | 6,836 | 7,701 | 8,651 |

| PERFORMANCE RATIOS (%) | |||

| Return on average equity | 15 | 26 | 21 |

| Return on average assets | 0.7 | 1.2 | 1.0 |

| Loans-to-deposits ratio | 25 | 21 | 19 |

| Cost-to-income ratio | 33 | 32 | 34 |

| CAPITAL ADEQUACY RATIO (%) | |||

| Capital Management | 14.10 | 15.32 | 15.15 |

Statement of Profit or Loss and Other Comprehensive Income – Total Operating Income

| KPI | OUTCOME | TARGET FOR NEXT FY |

|---|---|---|

| Due to challenging market conditions, the Bank is expected to achieve a marginal growth in its total operating income for FY20 at MUR 3.9bn. | The Bank achieved a total operating income of MUR 3.8bn, that is, 3% under budget. | Due to impact of COVID-19 and growing uncertainty on the market, the Bank is expected to achieve a lower total operating income for FY21 standing at MUR 2.4bn vis-à-vis last year. |

REVENUE

NET INTEREST INCOME

AfrAsia Bank reported a net interest income (“NII”) of MUR 2.0bn, that is, 12% lower than in the prior year. The year-on-year decrease was mainly driven by higher interest expense of MUR 1.1bn (2019: MUR 0.9bn). This effect was mainly on the back of the COVID-19 pandemic creating trade related uncertainty plunging the average volume and balances of placements and bonds due to financial market volatility and erosion of market value both in the domestic as well as international markets. Terms of many financial assets had to be renegotiated leading to dwindling interest income on customer grounds. While the Bank coped to manage its interest income, the growth in interest expense was the final knockback which dragged the net interest income down.

TOTAL ASSETS

The Bank’s asset base grew by 15% (MUR 20.6bn) and reached MUR 160.5bn by end of this year under review. This growth was primarily in cash and cash equivalents and due from banks and investment securities, while loans and advances and other assets were relatively stable when compared to last FY.

The bisection of the asset book sat in cash and cash equivalents and due from banks with an increase of MUR 16.5bn in 2020 as compared to the prior year. Investment securities increased by MUR 3.4bn (7%) primarily to upper possession of debt instruments at amortised cost; representing 30% of total assets.

Other assets, with its foremost component being mandatory balances with the Central Bank (MUR 2.2bn), did not experience major change. Furthermore, the proportion of the Bank’s total assets to Segment B represented 65% in 2020 which represents a slight increase when compared to 64% in 2019.

Read more: MANAGEMENT DISCUSSION AND ANALYSIS

Written by Super User on . Posted in Section A.

While the COVID-19 pandemic started as a sanitary crisis, its repercussions have cascaded to the overall global economy, resulting in a multidimensional crisis. In order to avoid a systemic financial crisis, we have seen an unprecedented government intervention worldwide. As compared to the 2008 Financial Crisis, Governments have been using banks as a transmission mechanism to implement their support and relief measures.

Risk management is the process of identifying, evaluating and managing the impact of uncertain events, and monitoring the consequences at acceptable levels. The risk-management cycle is comprised of four phases:

The process organises information about the possibility of a spectrum of undesirable outcomes into an inclusive, orderly structure that helps decision makers to make informed choices about their organisation’s ability to reduce risks.

The Bank’s risk appetite is defined by a risk appetite framework set by the Board. It aids to emphasise its strong risk culture and helps define thresholds to manage aggregate risks through an acceptable scale.

In line with Bank of Mauritius Guidelines on credit and country risk management, the Board has established a set of policies and procedures in respect of cross-border activities, which clearly translate to the Bank’s strategic goals and risk parameters.

Stress-Testing

Stress-testing (“ST”) is an integral part of the Bank’s risk management process as it consists of both sensitivity analysis and scenario analysis.

Stress testing is a fundamental tool to

Results of stress testing must impact decision making, including strategic business decisions via

The various type of scenario analysis performed at ABL are as follows:

Universal Perspective on Stress-Testing in COVID-19 context

Both the local and global economies have been severely impacted since the outbreak of the COVID-19 pandemic and this will impact capital adequacy and Stress test requirements of banks. In view of the unprecedented circumstances relating to the COVID-19 outbreak, the European Banking Authority (“EBA”) has decided to postpone the EU-wide stress test until 2021. This move was mirrored by the Bank of England, which announced the cancellation of stress testing requirements for eight major UK banks. The objective is to facilitate and incentivise the disbursement of credit to meet households and business requirements and still meet regulatory ratios.

In this current economic environment, similar to other banks, it was quite challenging for ABL to conduct stress-tests and estimate provisions under the IFRS 9 standard; as forward-looking judgement on possible losses from loans is very challenging and uncertain.

Notwithstanding the above challenges, the Bank has been guided by its Board in conducting a number of “Stress-Test Scenarios” or “What-If Scenarios” in order to assess potential balance sheet and profit or loss impact.

The mitigations are in line with the regulatory Internal Capital Adequacy Assessment Process (“ICAAP”) mitigation plan. ICAAP is an internal review requirement that evaluates capital adequacy, capital management and planning at banks with a specific focus on core risk factors.

The independent status of the Risk Management function is supported by a governance structure that provides for escalation of risk issues to senior management, Board sub-committees and the Board of Directors, as appropriate.

Fixed Line

Direct reporting to the CEO/Committee

Dotted Line

Operationally reports to the Board Committee

Fixed Line

Direct reporting to the CEO/Committee

Dotted Line

Operationally reports to the Board Committee

Committees established by Management

Risk can be defined as the uncertainty of an event to occur in the future. In the banking context, it is the exposure to the uncertainty of an outcome, where exposure could be defined as the position/stake banks take in the market. The main type of risks faced by the Bank are as follows:

Definitions of Risk types and Mitigating Actions

| Type of Risk | Description | Mitigating Actions | |

|---|---|---|---|

FINANCIAL RISK |

|||

| Credit Risk | It is the risk of loss arising out of the failure of obligors to meet their financial or contractual obligations when due. It is composed of obligor risk and concentration risk. |

|

|

| Country Risk | Country risk, also referred to as cross-border country risk, is the uncertainty that obligors (including the relevant sovereign, and the group’s branches and subsidiaries in a country) will be able to fulfil obligations due to the group given political or economic conditions in the host country. |

|

|

| Market Risk | Market risk is the risk of a change in the market value, actual or effective earnings, or future cash flows of a portfolio of financial instruments, including commodities, caused by adverse movements in market variables such as equity, bond and commodity prices, currency exchange and interest rates, credit spreads, recovery rates, correlations and implied volatilities in all of these variables. |

|

|

| Funding and liquidity Risk | Funding risk is the risk associated with the impact on a project's cash flow from higher funding costs or lack of availability of funds. Liquidity risk is defined as the risk that an entity, although solvent, cannot maintain or generate sufficient cash resources to meet its payment obligations in full as they fall due, or can only do so at materially disadvantageous terms. |

|

|

| Interest rate Risk | The risk arising from changes in interest rates or the prices of interest rate related securities and derivatives, impacting on the Bank’s earnings or economic value of equity. |

|

|

NON-FINANCIAL RISK | |||

| OperationalRisk | Operational risk is the risk of loss suffered as a result of the inadequacy of, or failure in, internal processes, people and/or systems or from external events. |

|

|

| Compliance Risk | Compliance risk is the risk of legal or regulatory sanction, financial loss or damage to reputation that the group may suffer as a result of its failure to comply with laws, regulations and codes of conduct and standards of good practice applicable to its financial services activities. |

|

|

| Information Risk | The risk of accidental or intentional unauthorized use, modification, disclosure or destruction of information resources, which would compromise the confidentiality, integrity or availability of information. |

|

|

| Cyber Risk | The Risk of failure, unauthorized or erroneous use of information systems resulting into financial loss, disruption or damage to the reputation of the bank. |

|

|

TRANSVERSAL RISK | |||

| Business strategic risk | Business strategic risk is the risk of earnings variability, resulting in operating revenues not covering operating costs after excluding the effects of market risk, credit risk, structural interest rate risk and operational risk. |

|

|

| Reputational risk | Reputational risk is the risk of potential or actual damage to the group’s image, which may impair the profitability, and/or sustainability of its business. |

|

Credit risk arises from the possibility of financial losses stemming from the failure of clients or counterparties to meet their financial obligations to the Bank. Credit processes control the credit risk of individual and corporate clients. Other sources of credit risk arise from trading activities, including: debt securities, settlement balances with market counterparties, amongst others.

The credit risk management objective is to maintain a rigorous and effective integrated risk management framework to ensure that all controls are in line with risk processes based on international best practices.

Organisation and Structure

The Bank has structured the responsibilities of credit risk management so that decisions are taken as close as possible to the business, whilst ensuring that there is an adequate segregation of tasks. Credit policies and processes are in place to ensure the effective monitoring and managing of credit risk in compliance with the Bank of Mauritius guidelines and AfrAsia Bank’s risk appetite.

The key focus of the Bank’s credit risk management approach is to avoid any undue concentrations in its credit portfolio, whether in terms of counterparty, group, portfolio, and country. The Bank has always kept its large exposures within the regulatory limits. For instance, our concentration ratio of large exposures above 10% was 200.65% as at 30 June 2020, well within the regulatory limit as shown below:

| Regulatory Credit Concentration Limit | As at 30 June 2020 |

|---|---|

| Credit exposure to any single consumer shall not exceed 25% of the Bank’s Tier 1 Capital | Highest single customer: 16.28% |

| Credit exposure to any group of closely-related customers shall not exceed 40% of the Bank’s Tier 1 Capital | Highest Group of closely related customer: 28.11% |

| Aggregate large credit exposures to all customers and Banks of closely related customers above 10% of Bank’s Tier 1 Capital shall not exceed 800% of Bank’s Tier 1 Capital | 200.65% |

As a fundamental credit principle, the Bank does not generally grant credit facilities solely on the basis of the collateral provided. All credit facilities are also based on the credit rating, source of repayment and debt-servicing ability of the borrower. Collaterals are taken when required by the bank to mitigate the credit risk. The collateral is monitored on a regular basis with the frequency of the valuation depending on the liquidity and volatility of the collateral value.

Enforcement legal certainty of enforceability and effectiveness is another technique used to enforce the risk mitigation. Where a claim on counterparty is secured against eligible collateral, the secured portion of the claim is weighted according to the risk weight of the collateral and the unsecured portion against the risk weight of the counterparty. To mitigate counterparty risk, the Bank also requires close out netting agreements. This enables the Bank to offset the positive and negative replacement values of contracts if the counterparty defaults. The Bank’s policy is to promote the use of closeout netting agreements and mutual collateral management agreements with an increasing number of products and counterparties in order to reduce counterparty risk.

As an indication, claims secured by cash and other charges represent 60% of the asset book, whilst unsecured portions account for 40% of total asset book. The value of collateral and other credit enhancements received on loans and advances as at 30 June 2020 is MUR 18.4bn (2019: MUR14.7bn and 2018: MUR18bn). All other financial assets are unsecured except for collateralised placements

The main types of collateral obtained are as follows:

| Collateral Details | Total | Total |

|---|---|---|

| MUR’000 | % | |

| Cash Secured | 1,119,385 | 4% |

| Fixed Charge | 7,986,268 | 26% |

| Floating Charge | 5,137,440 | 17% |

| Others | 4,160,955 | 14% |

| Total | 18,404,047 | 60% |

The Group and the Bank also request for personal guarantees from promoters, directors, shareholders and also corporate and cross guarantees from parent and sister companies.

The Bank adheres to the Guideline on Related Party Transactions issued by the Bank of Mauritius (BOM) in December 2001 and which was last reviewed in June 2015. In line with this Guideline, the Board of Directors has set up a Conduct Review Committee (“CRC”) to review and approve related party transactions.

The Bank’s policy on related party transactions sets out the

All related party transactions are reviewed and approved at the level of the Conduct Review Committee, which ensures that market terms and conditions are on arm length basis.

During the normal course of business throughout the year, the Bank entered into a number of banking transactions with its related parties. These include placements or loans to/from Banks, deposits as well as other normal banking transactions. As at 30 June 2020, related party exposure was within regulatory guidelines at 19.50% (Cat 1 and Cat 2).

The Bank has complied with all requirements of the Bank of Mauritius Guideline on Related Party Transactions. Related party reporting to the Bank of Mauritius is made on a quarterly basis. Moreover, all related party transactions (including those transactions, which are exempted as per the Guideline on Related Party Transactions) are monitored and reported to CRC on a quarterly basis.

Also known as position or price risk, market risk is the risk of losses on-balance sheet and off-balance sheet positions arising from movement in market prices. The prices include Foreign exchange rates, interest rates, equity prices, commodity prices and include implied volatilities (for options). The key drivers of market risk that the Bank is exposed to is mainly associated with fluctuations in interest rates and foreign exchange rates.

Market risk, also known as “systematic risk”, typically affects the entirety of a market. As such, this risk cannot be fully eliminated through diversification but may be reduced using the various hedging products and techniques such as options and futures.

The Bank has in place a sound risk management framework to monitor and manage the market risks that the Bank is exposed to on a daily basis, a framework of limits and triggers as approved and regularly reviewed by ALCO and the BRC which is in line with the Bank’s risk appetite and complement the regulatory limits as established by the central bank.

The Market Risk unit, being responsible in identifying and monitoring the Bank’s exposure to market risks, works in partnership with business lines to efficiently define market risk policies and procedures. As part of the independent risk management structure, the Market Risk unit reports to the Bank’s Head of Risk. The objective of market risk management is to help identify, assess and control risk, facilitate risk-return decision-making, reduce volatility in operating performance and provide transparency into the Bank’s market risk profile to senior management, the Board of Directors and regulators.

Foreign exchange or currency risk is the risk that exchange rate fluctuations may result in adverse changes in the value of current holdings and future cash flows that are denominated in currencies other than the base currency. This risk affects the Bank due to the multi-currency investing and lending activities.

For the financial year ended 30 June 2020, the Bank has maintained a daily net FX Open position against the Mauritian rupee that were well under the regulatory limit of 15% of Tier 1 capital as prescribed by the Bank of Mauritius.

Market Risk Monitoring and Controls

The Bank uses a variety of risk measures to estimate the size of potential losses for both moderate and more severe scenarios, under both short-term and long-term time horizons.

Not all activities necessarily to have the same limit structure, as a result, adequate market risk limits are established in accordance with the complexity of the activity and risks undertaken.

Market risk reports are regularly communicated to Senior Management, ALCO and the BRC highlighting all market risk matters and relevant issues are promptly escalated.

Value at Risk (“VaR”)

The Value at Risk is a statistical measure of risk that is used to quantify risks across products, per types of risks and aggregate risk on a portfolio basis, from individual trading desks up to the Bank level. VaR models provide an estimate of the potential future loss of a position over a specified horizon, given a required degree of confidence in the estimate.

The Bank has adopted a parametric approach (Variance-Covariance method) to compute the VaR at a 99 percent confidence level using a 10 days daily volatility change. The holding period used is one day due to the fluid composition of the portfolio so as to proactively manage the underlying risk on a day-to-day basis.

Sensitivity Limits

Sensitivity limits are used to monitor the risk incurred due to changes in several pricing parameters. These measurements include Portfolio Duration limits and PV01 limits.

The PV01 is a measure of sensitivity to a 1bp (basis point) change in interest rates. The outcomes may be positive or negative reflecting the percentage change in value for a 1bp or a 100bp (PV100) rise or fall in interest rates.

Gross Position Limits and Transaction Limits

Absolute gross position limits are set up to mitigate concentration risk, thus restricting the maximum exposure which the Bank can be exposed to vis-a-vis one particular market, sector, or instrument.

These limits are usually referred to as portfolio restrictions upon creation of the portfolio. Many trading portfolios have limits on the number of certain products that can be held in the portfolio and these are often due to liquidity issues (e.g. limits on the maximum $ amount or percentage of portfolio in corporate bonds, etc.).

Maturity Limits

The majority of fixed income products are contracts that expire at a certain date. In general, the marked-to-market valuations of these products are more difficult to obtain if the products have long-term maturity, low liquidity or low credit rating. Maturity limits are established for portfolios that trade those types of products.

Liquidity and funding risk are the risk that the Bank will be unable to meet its daily cash and financial obligations as they fall due or do so at materially significant costs. Liquidity risk arises from mismatched cash flows related to the Bank’s assets and liabilities as well as the characteristics of some products with ambiguous maturities.

The Bank’s primary objective as a financial institution is to manage liquidity such that it supports the Bank’s business strategy and allows it to honor its commitments when they come due, even under stress. This is done primarily by implementing a liquidity risk policy framework approved by the Board, which establishes a risk appetite, triggers, risk indicators, monitoring structures and escalation trees.

The Bank’s Assets and Liabilities Committee (“ALCO”) under guidance from the Board Risk Committee (“BRC”) is responsible for the assessment, monitoring and management of the Bank’s liquidity risk and strategy and ensuring compliance with both internal and regulatory limits.

As per the principles outlined in the Bank’s liquidity risk policy, the following approach is adopted to manage liquidity risk both under a business-as-usual and stressed scenario.

| Short-term liquidity risk management | Structural (longer-term) liquidity risk management | Contingency Liquidity Risk Management |

|---|---|---|

| Managing intra-day liquidity positions | Identification of structural liquidity mismatches against tolerance limits and breaches are escalated to ALCO | Setting of appropriate early warning indicators |

| Monitoring daily and short-term cash flow requirements | Managing term lending capacity by considering behavioural profiling of ambiguous maturity assets and liabilities | Undertaking liquidity stress testing and scenario analysis |

| Setting up of interbank and repo lines | Monitoring depositor concentration against internal limits and holding sufficient marketable assets against the Bank’s deposit base. | Ensuring a contingency funding plan is in place with appropriate actions plans and escalation process. |

| Setting of deposit rates according to market conditions and ALCO approved targets. | Managing long-term cash flows |

Regulatory Environment

The Bank works closely with the central bank to implement regulatory liquidity standards. The Bank adapts its processes and policies to reflect the Bank’s liquidity risk appetite towards these new requirements.

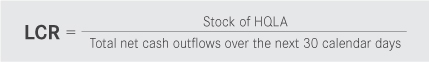

Liquidity Coverage Ratio (“LCR”)

The Bank of Mauritius, in line with Basel principles, issued Liquidity Coverage Ratio requirements for banks in November 2017, as part of the Guideline on Liquidity Risk Management.

The LCR was introduced primarily to ensure banks maintain an adequate stock of unencumbered high-quality liquid assets (“HQLA”), that consist of cash or assets convertible into cash at little or no loss of value in private markets, to meet liquidity needs for a 30-calendar day time period, under a severe liquidity stress scenario.

The Bank publishes the LCR on a quarterly basis and reports to the Bank of Mauritius on a fortnightly basis.

The Bank of Mauritius adopted the following phased in approach to the LCR requirement:

| As from 30 November 2017 |

As from 31 January 2018 |

As from 31 January 2019 |

As from 31 January 2020 |

|

|---|---|---|---|---|

| LCR in Mauritian rupees | 100% | 100% | 100% | 100% |

| LCR in material foreign currencies | 60% | 70% | 80% | 100% |

| Consolidated LCR | 60% | 70% | 80% | 100% |

The following table provides average LCR data, calculated using month end data for the quarter ended 30 June 2020. The bank’s average LCR was 349%, well above the 100% regulatory requirement, demonstrating a robust liquidity position.

LCR Disclosure Requirements

| (Consolidated in MUR’m) | TOTAL UNWEIGHTED VALUE (quarterly average of monthly observations)1 | TOTAL WEIGHTED VALUE (quarterly average of monthly observations)1 | |

|---|---|---|---|

| HIGH-QUALITY LIQUID ASSETS | |||

| 1 | Total high-quality liquid assets (“HQLA”) | 47,387 | 46,860 |

| CASH OUTFLOWS | |||

| 2 | Retail deposits and deposits from small business customers, of which: | 19,811 | 1,981 |

| 3 | Stable deposits | - | - |

| 4 | Less stable deposits | 19,811 | 1,981 |

| 5 | Unsecured wholesale funding, of which: | - | - |

| 6 | Operational deposits (all counterparties) | - | - |

| 7 | Non-operational deposits (all counterparties) | 101,396 | 50,011 |

| 8 | Credit and liquidity facilities | 1,105 | 90 |

| 9 | Other contingent funding obligations | 1,982 | 1,628 |

| 10 | TOTAL CASH OUTFLOWS | 124,294 | 53,709 |

| CASH INFLOWS | |||

| 11 | Inflows from fully performing exposures | 43,213 | 41,544 |

| 12 | Other cash inflows | 1,693 | 1,693 |

| 13 | TOTAL CASH INFLOWS | 44,906 | 43,237 |

| TOTAL ADJUSTED VALUE | |||

| 14 | TOTAL HQLA | 46,860 | |

| 15 | TOTAL NET CASH OUTFLOWS | 13,428 | |

| 16 | LIQUIDITY COVERAGE RATIO (%) | 349% | |

| 17 | QUARTERLY AVERAGE OF DAILY HQLA2 | 38,248 | |

As part of its annual ICAAP process, the Bank applies a stress on its stock of liquid assets, based on stressed depositor outflow simulations. These scenarios factor in both bank specific and systemic risk.

In assessing the adequacy of its stock of liquid assets, the Bank applies a haircut on the market value of its liquid assets to reflect forced sale discounts.

In line with Bank of Mauritius requirements, the Bank maintains a comprehensive liquidity contingency funding plan with well-defined action plans and an approved escalation tree in the event of a liquidity crisis. Qualitative and quantitative liquidity early warning indicators are tracked and reported at ALCO on a monthly basis.

The Bank monitors various liquidity risk limits and ratios against an internally approved risk appetite. The Bank’s liquidity risk appetite is based on the following principles:

To protect depositors from unexpected crisis situations, the Bank holds a portfolio of unencumbered liquid assets that can be readily liquidated to meet financial obligations. The majority of unencumbered liquid assets are held in Mauritian Rupees or United States Dollars. Moreover, all assets that can be quickly monetized are considered liquid assets. The Bank’s liquidity reserves do not factor in the availability of the Bank of Mauritius’ overnight borrowing quota.

The table below provides a breakdown of the Bank’s eligible liquid and marketable instruments as defined by the Basel committee on banking supervision and the Banking Act 2004.

| As at 30 June 2020 (MUR'm) | Bank-owned liquid assets1 | Liquid assets received2 | Total Liquid assets | Encumbered liquid assets3 | Encumbered liquid assets3 |

|---|---|---|---|---|---|

| Cash and deposits with financial institutions | 56,565 | - | 56,565 | - | 56,565 |

| Securities | |||||

| Issued or guaranteed by US Treasury | 22,228 | - | 22,228 | - | 22,228 |

| Issued or guaranteed by local government/central bank | 16,183 | 10,006 | 26,189 | - | 26,189 |

| Other debt securities | 1,101 | - | 1,101 | - | 1,101 |

| Total | 96,077 | 10,006 | 106,083 | - | 106,083 |

Funding Mix & depositor concentration ratio

The Bank maintains a good balance of its funding through appropriate diversification of its funding sources. The Bank also diversifies its funding by currency, geography and maturity. Management’s objective is to achieve an optimal balance between demand and term deposits in line with the Bank’s asset deployment strategy.

Funding and liquidity levels remained sound and robust throughout the year and the Bank does not foresee any event, commitment or demand that might have a significant impact on its funding and liquidity risk position.

As at 30 June 2020, the Bank’s depositor concentration ratios were as follows:

| MUR deposits | |

|---|---|

| Single depositor | 4.70% |

| Top 10 depositors | 15.22% |

| FCY deposits | |

| Single depositor | 5.88% |

| Top 10 depositors | 12.76% |

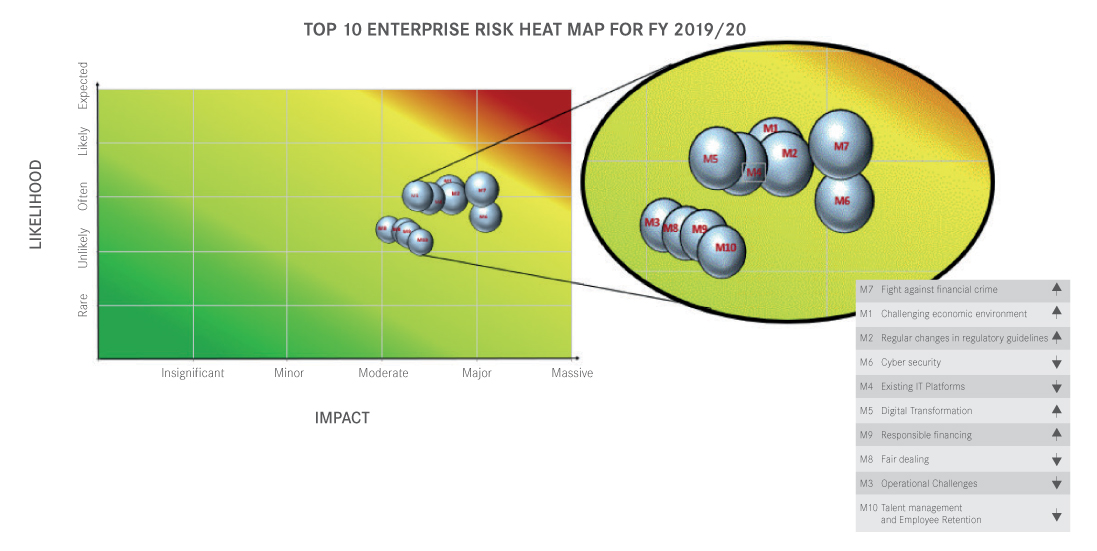

The Top 10 Principal Risks of the Bank have been evaluated where all departments were requested to provide their assessment through a rating exercise with regards to their actual business activities. The snapshot below depicts the inherent risks of the Top 10 Principal Risks in terms of likelihood and impact.

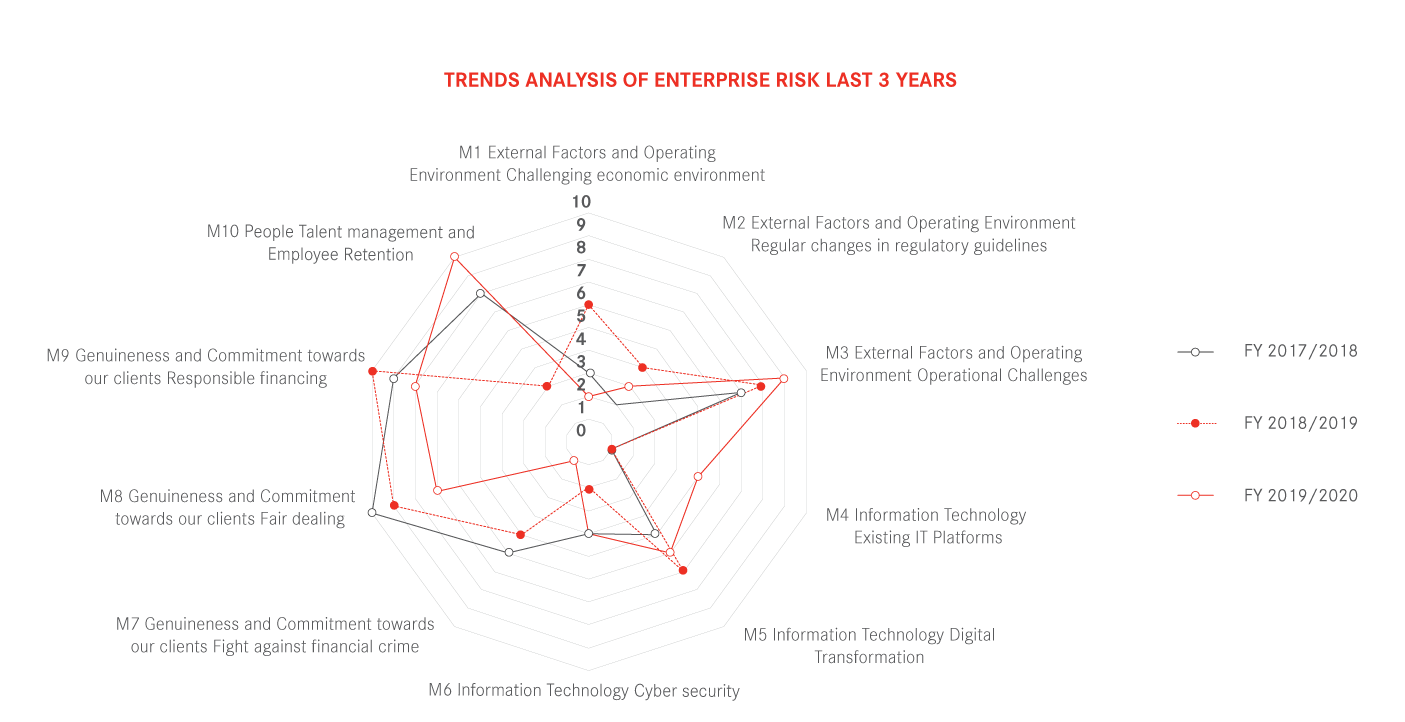

The diagram below depicts the trends of the Top 10 Principal Risks between the FY 2017/2018, FY 2018/2019 and FY 2019/2020. Fight against Financial Crimes, Challenging Economic Environment and Regular Changes in regulatory guidelines which position themselves first, second and third among the heightened risks during this financial year. On the other side risk associated with Existing IT Platform and Cyber Security which were previously positioned first and second in previous year have moved to fifth and fourth position respectively. Talent Management which was placed third in the previous financial year has moved to the tenth place.

The Bank is taking appropriate actions to mitigate the inherent risk in these areas. No major movement observed for the other remaining risks identified and they are containable within the Bank’s risk profile.

AfrAsia always promotes a culture where operational risk is everyone’s responsibility. Operational risk (“OR”) is the risk of achieving our strategy or objectives as a result of inadequate or failed in internal processes, people, and systems or from external events which can lead to adverse customer impact, reputational damage, litigation or financial loss. Operational risk is inherent in the day to day operations, activities and products and services which the Bank offered.

The Bank has a well-defined structure for operational risk that complies with regulatory and best practice requirements and is aligned with the risk culture and the risk profile of its activities. This is supplemented through an operational risk charter and operational risk framework which include the three lines of defense (BUs, Control Units, and Internal/External Auditors) and involvement of senior management ensuring the coverage that all operational risks are efficiently managed across its activities.

The OR framework includes a risk control self-assessment (“RCSA”) process, risk impact likelihood matrix, key risk and control indicators, Early Warning Indicators (“EWIs”), a robust operational risk event management tool and escalation process, scenario analysis, audit recommendations, external information sources (external events or industry reports) and operational losses process.

AfrAsia continuously improve operational control procedures to keep pace with new regulation and best practice in the market through holistic follow up of risks and their mitigating controls.

The AfrAsia fosters awareness and knowledge of operational risks at all level of organizations through its risk pro-culture. During the financial year ended 30 June 2020, a number of different training sessions were conducted using the e-learning platform (“LMS”) and face to face sessions which addressed general knowledge of operational risk.

AfrAsia calculates its minimum (Pillar I) operational risk capital requirement using the Basic Indicator Approach (BIA) where the capital charge is 15% of average gross income over the last 3 years. AfrAsia has an Early Warning Indicators (“EWIs”) for Operational Risk Loss which is 0.1% to 1.0 % of gross income.

The Operational Risk Radar depicts the position of operational risk incidents with operational losses according to the Basel Event Classification under the four-quadrant people, process, system and external factors vis a vis the Early Warning Indicators (“EWIs”) set.

At AfrAsia, Information Technology is more geared towards enabling sophisticated product development, better market infrastructure, and helps the Bank reach geographically distant and diversified markets. The Bank leverage maximum effort on FinTech to keep pace in the digitalized market while keeping aligned to its IT Security policies.

Data and information: Effective deployment of data and information assets is in the form of Management information system, business intelligence / analytics, decision support and forecasting. Data and information being among the most valuable assets of the organization, the information strategy of the Bank focuses not only on the above but also on data governance, to ensure integrity and consistency of data at every stage of the data lifecycle, maintaining adherence to the General Data Protection Regulation (“GDPR”) and the Mauritius Data Protection Act (“DPA”) 2017. AfrAsia is committed to ensure that privacy rights and entitlements are adequately protected in relation to the techniques used to capture, transmit, manipulate, record or store data relating to individuals.

Technology, Infrastructure and Security: With technology evolving faster than ever, the primary challenge for an enabling technology is to ensure that the Bank is adequately prepared and equipped to sustain the rigorous and continuous evolution of requirements for new technologies in the era of digital innovation and artificial intelligence, whilst managing the costs and the associated risks.

The Bank’s Information Technology (“IT”) and Information Security (“IS”) frameworks are built on global standards like ITIL, ISO 27001 etc. and the governance principles are modeled along the lines of COBIT, ISO/IEC 27014:2013. The practice of governance includes regular reviews with executive management and extends up to the Board with regular updates and feedback to and from the Board. Internal, external and regulatory audits play a crucial role in the governance cycle with intermittent checks on the policies and implementation of same.

Information Risk: Information Risk aims to maintain the confidentiality, integrity and availability of information assets when being stored, processed and transmitted. Management focus is oriented to ensure that all measures converge towards adopting the best practices including governance through frameworks & standards, and establish efficiency and consistency of protections.

AfrAsia Bank Limited (ABL) is constantly improving information security to ensure that our systems are not compromised and the customers retain the confidence in our connectivity. ABL follows international cybersecurity frameworks as part of its cybersecurity activities.

Globally, all categories of cyber-attacks have witnessed an increase during the COVID-19 pandemic. Being aware of the risks and impact associated with cyber-attacks, ABL has had to reboot its cyber risk management and also to support remote working capabilities for its staff. Additional controls and guidance for staff working remotely include but are not limited to:

Cyber Risk initiatives being an integral part of the overall information risk & security have been allocated more resources to ensure complete safety. Preventing cyber-attacks remains an integral part of risk management.

Therefore, ABL remains committed to ensure that continuous enhancement are made towards our cyber security system.

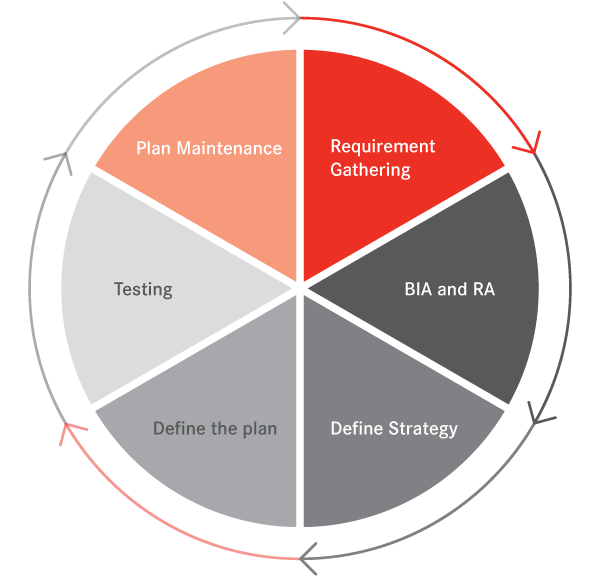

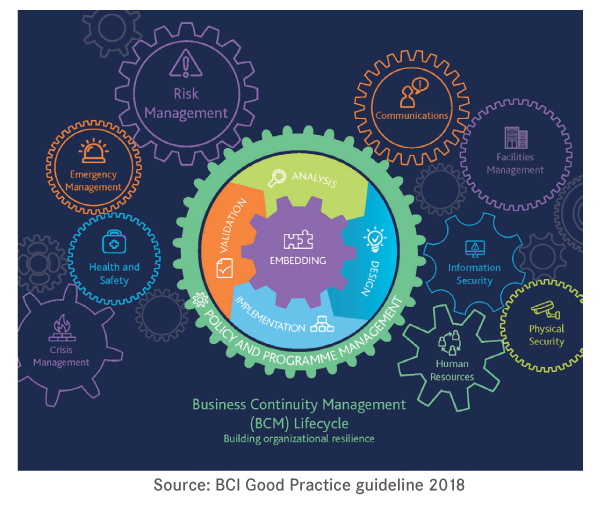

Business Continuity Management (“BCM”) Policy includes plans to mitigate operational risks, and as a commitment to continue business to our shareholders, customers and employees. Business Impact Analysis, Business Recovery Strategies and Emergency Response plans are defined and implemented to provide for a Disaster Recovery site with data being updated as per preset recovery time objectives. This minimizes operational, financial, legal, reputational and other material consequences arising from any disruption to the primary IT infrastructure.

The BCM policy reviewed in May 2019 is in line with the Business Continuity Institute Good Practice Guidelines 2018 (“BCI GPG 2018”), which is built on ISO requirements namely ISO 22301:2012 for business continuity management and ISO/TS 22317:2015 for Business Impact Analysis (BIA).

The management team of the Bank is committed to the following statement:

“We will take all necessary measures to ensure the continuity of business operations and to minimize recovery time in the case of disaster (natural or otherwise) or in the event of an emergency.”

The Bank has a BCM Steering Committee to review the processes after each testing exercise and to review the policy every year with a view to continuously improve resilience. The ultimate objective is to cater for any eventual disruption of operations to be restored within a minimum lapse of time such that the Bank resumes to normal operations within a reasonable time frame.

At least one BCM test is performed annually for all critical infrastructure involving all functions and user groups of the Bank to ensure the effectiveness of the processes and the readiness of the infrastructure and people. The Bank has adopted a cyclical approach residing on the four pillars: Readiness, Prevention, Response and Recovery /Resumption to continuously improve on the BCM and attain an efficient and acceptable level. Rigorous administration and maintenance, as well as any event experienced, will necessitate revisions and/or plan additions. The strategy adopted for an efficient BCM is to continuously test, train, evaluate and maintain the BCP.

The BCM policy is in place for moving towards a better resilient framework to protect the interest of all stakeholders of the Bank. During the COVID-19 lock down period, the Bank followed our BCM policy and Government of Mauritius and World Health Organization protocols. The Bank also adapted our customer services among others, to be more gear towards technology, while maintaining our controls to run the Bank’s operations. Furthermore, we applied strict sanitary measures and perpetuate our usual awareness campaign to keep our staffs informed about the evolving situation and kept employee welfare.

Bank’s operations. Furthermore, we applied strict sanitary measures and perpetuate our usual awareness campaign to keep our staffs informed about the evolving situation and kept employee welfare.

Customer Risk is the risk associated to the Customer profile, product and services/transactions, channels, jurisdictions and segmentation among others. To better address and effectively manage KYC/AML Risk, the AML desk has been revamped and attached under the risk management arena.

The AML desk as a second line of defense ensures the implementation of effective AML framework with adequate processes and controls with a view rendering its products and services away from financial crimes and tracked down effectively and promptly suspicious transactions.

The Bank is continuously enhancing its processes on a risk-based approach to tackle customer due diligence requirements, apply best practices for customer onboarding, leverage on tools and techniques to efficiently monitor transactions and detect any anomalies.

To perform its daily activities effectively, the Bank depends on in house and external technology to ensure that customer risks are captured and mitigated accordingly.

CAPITAL STRUCTURE AND ADEQUACY

| AFRASIABANK LIMITED | 2020 | 2019 | 2018 | |

| MUR’000 | MUR’000 | MUR’000 | ||

| Common Equity Tier 1 capital: instruments and reserves | ||||

| Share Capital | 3,641,049 | 3,641,049 | 3,641,049 | |

| Statutory reserve | 920,631 | 692,398 | 454,679 | |

| Retained earnings | 2,297,788 | 1,836,242 | 1,277,521 | |

| Accumulated other comprehensive income and other disclosed reserves | 198,526 | 108,365 | 88,728 | |

| Common Equity Tier 1 capital before regulatory adjustments | 7,057,994 | 6,278,054 | 5,461,977 | |

| Common Equity Tier 1 capital: regulatory adjustments | ||||

| Other intangible assets | (269,914) | (243,398) | (249,585) | |

| Deferred Tax | (124,388) | (100,953) | (141,462) | |

| Significant investments in the capital of banking, financial and insurance entities that are outside the scope of regulatory consolidation, net of eligible short positions (amount above 10% threshold) |

- | - | (151,650) | |

| Total regulatory adjustments to Common Equity Tier 1 capital | (394,302) | (344,351) | (542,697) | |

| Common Equity Tier 1 capital (CET1) | 6,663,692 | 5,933,703 | 4,919,280 | |

| Additional Tier 1 capital: instruments | ||||

| Instruments issued by the Bank that meet the criteria for inclusion in Additional Tier 1 capital (not included in CET1) | 1,323,265 | 1,323,552 | 1,360,715 | |

| Tier 1 capital (AT1) | 1,323,265 | 1,323,552 | 1,360,715 | |

| Tier 1 capital (T1 = CET1 + AT1) | 7,986,957 | 7,257,255 | 6,279,995 | |

| Tier 2 capital: instruments and provisions | ||||

| Instruments issued by the Bank that meet the criteria for inclusion in Tier 2 capital (and are not included in Tier 1 capital) | - | - | 11,380 | |

| Provisions or loan-loss reserves (subject to a maximum of 1.25 percentage points ofb credit risk-weighted risk assets calculated under the standardised approach) | 399,896 | 463,159 | 415,825 | |

| Tier 2 capital before regulatory adjustments | 399,896 | 463,159 | 427,205 | |

| Tier 2 capital: regulatory adjustments | ||||

| Significant investments in the capital of banking, financial and insurance entities thatare outside the scope of regulatory consolidation (net of eligible short positions) | - | - | (37,913) | |

| Total regulatory adjustments to Tier 2 capital | - | - | (37,913) | |

| Tier 2 capital (T2) | 399,896 | 463,159 | 389,292 | |

| Total Capital (capital base) (TC = T1 + T2) | 8,386,853 | 7,720,414 | 6,669,287 | |

| Risk weighted assets | ||||

| Credit Risk | 49,912,135 | 43,810,049 | 41,591,459 | |

| Market Risk | 245,359 | 499,978 | 332,436 | |

| Operational Risk | 5,205,652 | 4,404,267 | 3,421,490 | |

| Total risk weighted assets | 55,363,146 | 48,714,294 | 45,345,385 | |

| Capital ratios (as a percentage of risk weighted assets) | Regulatory Limits |

|||

| CET1 capital ratio | 9.38% | 12.04% | 12.18% | 10.85% |

| Tier 1 capital ratio | 10.88% | 14.43% | 14.90% | 13.85% |

| Total capital ratio | 12.88% | 15.15% | 15.85% | 14.71% |

RECONCILIATION WITH AFRASIA BANK’S AUDITED FINANCIAL STATEMENTS

| 30 June 2020 | ||

| Statement of Financial Position as in published financial statements | Statement of Financial Position as per Basel III | |

| ASSETS | MUR’000 | MUR’000 |

| Cash and cash equivalents | 69,032,249 | 71,208,501 |

| Due from banks | 11,132,738 | 11,137,615 |

| Derivative financial instruments | 321,961 | 321,961 |

| Loans and advances to banks | 5,245,927 | 5,257,597 |

| Loans and advances to customers | 23,043,922 | 23,211,433 |

| Investment securities | 48,664,900 | 48,672,693 |

| Debt instruments at fair value through profit or loss | 2,042,480 | 2,042,480 |

| Debt instruments at amortised cost | 46,612,747 | 46,620,540 |

| Equity Investment at fair value through other comprehensive income | 9,673 | 9,673 |

| Investment in Subsidiary | - | - |

| of which: Significant capital investments in financial sector entities exceeding 10% threshold | - | - |

| Asset held for distribution | 38,277 | 38,277 |

| Property and equipment | 170,977 | 170,977 |

| Intangible assets | 269,914 | 269,914 |

| Right of use assets | 80,017 | 80,017 |

| Deferred tax assets | 124,388 | 124,388 |

| Other assets | 2,347,559 | 174,633 |

| TOTAL ASSETS | 160,472,829 | 160,668,006 |

| LIABILITIES AND EQUITY | ||

| Due to banks | 13,252 | 13,252 |

| Deposits from banks | 96,365 | 96,365 |

| Deposits from customers | 150,850,619 | 150,850,619 |

| Derivative financial instruments | 107,168 | 107,168 |

| Debts issued | - | - |

| Financial liabilities measured at fair value through profit or loss | - | - |

| Retirement benefits obligation | 99,851 | 99,851 |

| Current tax liabilities | 13,618 | 13,618 |

| Lease liabilities | 82,571 | 82,571 |

| Provisions | - | 202,334 |

| of which: Provision reflected in regulatory capital | - | 202,334 |

| Other liabilities | 568,061 | 560,904 |

| TOTAL LIABILITIES | 151,831,505 | 152,026,682 |

| EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT | ||

| Ordinary Shares | 3,641,049 | 3,641,049 |

| of which amount eligible for CET1 | - | 3,641,049 |

| Class A shares | 1,385,768 | 1,385,768 |

| of which amount eligible for AT1 | - | 1,323,265 |

| Retained earnings | 2,297,788 | 2,297,788 |

| Other reserves | 1,316,719 | 1,316,719 |

| of which: Provision reflected in regulatory capital | - | 197,562 |

| TOTAL EQUITY | 8,641,324 | 8,641,324 |

| TOTAL LIABILITIES AND EQUITY | 160,472,829 | 160,668,006 |

The total asset book witnessed a growth of MUR 20.6bn for the year ended June 2020 versus the same period in 2019. The total risk weighted assets as at end of the current financial year stood at MUR 55.4bn, demonstrating an increase of 14% in comparison to MUR 48.7bn as at end of June 2019. Despite the recognition of a net profit after tax of MUR 1.5bn in retained earnings, the capital adequacy ratio fell from 15.85% to 15.15% as at end of June 2020 on the back of an increase in risk weighted assets of MUR 6.7bn. The capital adequacy ratio was well above the regulatory limit of 12.88 % for the year 2020. The regulatory limits include a capital surcharge of 1.00% in 2020, given that the Bank is classified as a Domestic Systemically Important Bank.

Analysis by risk type:

Read more: RISK MANAGEMENT REPORT

Written by Super User on . Posted in Section A.

CORPORATE GOVERNANCE REPORT

The Board of Directors (Board) deems that endorsing quality norms and beliefs of good governing practices in the Bank provide a solid bedrock for sustainability, a long-haul value creation for all of its stakeholders and a culture of transparency. The Board entrusts its powers through its leadership in the hierarchy eulogising elevated standards of corporate governance to direct and supervise the conduct of the business and the affairs of the Bank ethically and effectively.

GENERAL

AfrAsia Bank Limited (the “Bank” or “AfrAsia Bank” or “ABL” or “AfrAsia”) has, through its Board of Directors, taken the required steps to ensure compliance with the principles set out in the National Code of Corporate Governance and explained how these principles have been applied to with the exceptions of those disclosed in the “Statement of Compliance” on page 73 along with underlying principle behind the non-compliance.

Further to a re-constitution of its Board of Directors post year end, some resignations and appointments were noted post year end for which the details can be found throughout the report.

Disclosures pertaining to the eight principles of the Code have been made in different sections of the Annual Report, as outlined below:

| Principles of the Code | Relevant sections of the Annual Report |

|---|---|

| Principle 1: Governance Structure | Corporate Governance Report |

| Principle 2: The Structure of the Board and its Committees | Corporate Governance Report |

| Principle 3: Director Appointment Procedures | Corporate Governance Report |

| Principle 4: Director Duties, Remuneration and Performance | Corporate Governance Report |

| Principle 5: Risk Governance and Internal Control | Corporate Governance Report and Risk Management Report |

| Principle 6: Reporting with Integrity | Corporate Governance Report, Sustainability Report and Section B – Financial Statements |

| Principle 7: Audit | Corporate Governance Report |

| Principle 8: Relations with Shareholders and Other Key Stakeholders | Corporate Governance Report |

PRINCIPLE ONE – GOVERNANCE STRUCTURE

OUR GOVERNANCE FRAMEWORK AND ACCOUNTABILITIES

ABL, a public company incorporated on the 12th of January 2007, holds a banking licence which was issued on the 29th of August 2007. Its core banking and transactional capabilities are in Mauritius along with a representative office in South Africa. It is a Public Interest Entity (“PIE”) as per the Financial Reporting Act 2004 and adheres with the requirements of the relevant rules, regulations and legislations.

The Bank operates under the aegis of a unitary Board, collectively geared in guiding and directing the organisation to take the necessary steps to adhere, to the best of the Board’s knowledge, to all legal and regulatory requirements, such as:

ABL has in place a Conduct and Ethics Policy and in line with same, it is committed to employing the right people and to promote a culture of mutual respect and ethical behavior. Employees and Directors are expected to treat each other with consideration and respect and are not permitted to engage in conduct which is hostile or offensive to another person. The Bank promotes transparency and all staff and Directors are made aware and accountable of their responsibilities.

A copy of the Bank’s Conduct and Ethics Policy is available on its website.

OUR GOVERNANCE STRUCTURE AS AT 30 JUNE 2020

KEY GOVERNANCE POSITIONS

The Terms of Reference, which the Board reviews and approves as and when required, defines all key governance positions within the Bank and their corresponding accountabilities which are critical drivers of strategic performance and for optimised adherence to proper governance. A clear line of demarcation is drawn between the roles and responsibilities of the Chairperson and the Chief Executive Officer (CEO) to impede any unfettered powers; these are listed below:

Chairperson of the Board

The roles of the Chairperson are mainly:

Chief Executive Officer (CEO)

The main functions of the CEO are:

SENIOR MANAGEMENT TEAM PROFILE

SANJIV BHASIN

Chief Executive Officer

JENNIFER JEAN-LOUIS

Chief Financial Officer

ROBIN BRYAN SMITHE

Senior Executive – Head Corporate Banking

YOGESH GOKOOL

Senior Executive – Head Global Business

SEVAMI MOONIEN

Head of Credit Risk

CHUNDUNSING (RAKESH) SEESURN

Head of Risk

MAUREEN TREANOR

Head of Human Resources and Change Management

NICOLAS FABIEN HARDY

Chief Technology & Operations Officer

SUNEETA MOTALA

Chief Marketing Officer

PARIKSHAT (PARIK) TULSIDAS

Senior Executive – Treasury and Markets

THIERRY VALLET

General Manager

Chief Executive Officer

SSenior Executive – Head Global Business

Chief Technology & Operations Officer

Chief Financial Officer

Head of Credit Risk

Chief Marketing Officer

Head of Risk

Senior Executive – Head Corporate Banking

Head of Human Resources and Change Management

Senior Executive – Treasury and Markets

General Manager

PRINCIPLE TWO – THE STRUCTURE OF THE BOARD AND ITS COMMITTEES

The Board is responsible for the overall stewardship of the Bank and thus plays a vital role in ensuring that the appropriate level of corporate governance is maintained.

The powers of Directors are set out in the Bank’s Constitution and in the Terms of Reference for the Board. The Board is aware of its responsibilities to ensure that the Bank adheres to all relevant legislations such as The Banking Act 2004 (amended August 2020), the Financial Reporting Act 2004 (amended 2018), the Financial Services Act 2007 and The Companies Act 2001 of Mauritius. The Board reassesses its Terms of Reference as and when required.

The Board also follows the principle of good corporate governance as recommended in the “National Code of Corporate Governance 2016” and BOM’s “Guidelines on Corporate Governance 2001” (revised October 2017). It reviews and approves whenever deemed necessary the Bank’s Code of Ethics to warrant that they are in line with the Bank’s objectives and also monitors and evaluates the Bank’s compliance with its Code of Ethics

PRINCIPLE THREE – DIRECTOR APPOINTMENT PROCEDURES

BOARD MEMBER APPOINTMENT AND RE-APPOINTMENT

The Board has mandated the Corporate Governance Committee to select and review candidates of the proposed directorship guided by legal and regulatory requirements. Candidates appointment should be conducted with appointments being made, on merit, against objective criteria in relation to skills, knowledge, experience, independence and gender balance which will add to the benefits of diversity on the Board.

Once the selection process has been completed, the Corporate Governance Committee makes its recommendation to the Board for approval.

For the purpose of filling a casual vacancy, the Board may approve the proposal of the Corporate Governance Committee. As such, the proposed Director shall stay in office until the next annual meeting whereby he/she can be appointed by the shareholders.

The Board members’ selection and nomination process can be classified into the main steps illustrated below:

The newly appointed Director shall receive a Letter of Appointment which contains the following details:

During the year ended 30 June 2020, the Board did not appoint any new Directors.

INDUCTION AND PROFESSIONAL DEVELOPMENT

Following appointment on the Board, the Directors receive an extensive and formal tailored induction training to familiarize themselves with the activities of the Bank. In addition to receiving an information pack, the Directors also get accustomed with the Terms of Reference of the Board and their statutory duties and obligations.

The Chairperson ensures that the development needs of the Directors are identified and consequently appropriate training is provided to continuously update their skills and knowledge.

In line with continuous professional development, the Directors attended workshops about Asset Liability Management refresher training and initiation of the application of new credit impairment and income recognition guidelines.

SUCCESSION PLANNING

In accordance with its Terms of Reference, the Board is responsible for the succession planning of the Board, the Chief Executive Officer and Senior Management of the Bank.

The Board has mandated the Corporate Governance Committee to put in place the succession plans, especially that of the Chairperson and of the CEO. Same has been formalised in the Terms of Reference of the Corporate Governance Committee.

The Corporate Governance Committee shall be responsible for the identification and selection of potential candidates.

PRINCIPLE FOUR – DIRECTOR DUTIES, REMUNERATION AND PERFORMANCE

LEGAL DUTIES

All Directors, including any alternate Director, are fully knowledgeable of their fiduciary duties as laid out in The Companies Act 2001 of Mauritius.

CODE OF ETHICS FOR THE BOARD

The Bank has a Code of Ethics for its Board; same is available on the Bank’s website. (https://www.afrasiabank.com/media/3187/code-of-ethics-Board-of-directors.pdf)

The Board believes that it must lead by example and encourages the Bank’s Senior Management, the staff and other relevant stakeholders to follow the Conduct and Ethics Policy and to act ethically. The Board monitors and evaluates compliance with its Code of Ethics as and when required.

BOARD APPRAISAL

The Board regularly undergoes a performance appraisal exercise, in accordance with the National Code on Corporate Governance for Mauritius and BOM’s “Guidelines on Corporate Governance”. The Directors are requested to evaluate the Board on the following main criteria:

The regular Board appraisal exercise is performed internally through the Company Secretary, under the leadership of the Chairperson. It is generally done via questionnaires and the results are presented to the Corporate Governance Committee and ultimately, to the Board once they are available. The remarks and recommendations received are shared with the Board to enable the Directors to take appropriate steps where necessary and possible.

No Board appraisal exercise has been performed for the year under review. The Board is considering to perform a Board appraisal exercise in the next financial year.

The recommendation of the Code revolving around the use of an external consultant for Board appraisal exercise has been noted for forthcoming assessments.

DIRECTORS’ REMUNERATION AND BENEFITS

The Corporate Governance Committee acts as Nomination and Remuneration Committee as and when required and as part of its duties it determines, agrees, develops and reviews the Bank's general policy on executive and senior management remuneration.

The Executive Director who is in full time employment with the Bank is entitled to a fixed salary as per his contract of employment and he does not receive any additional remuneration for attending the Board meetings and Committees.

The table below sets out the fee structure for Non-Executive Directors:

| Category of Member | MUR’ 000 | Fee details |

|---|---|---|

| Chairperson | 550 | Fixed fee per month |

| Board Member |

440 | Fixed fee per annum |

| Committee Member | 45 | Per attendance |

| Additional fee to Credit Committee Member | 540 | Yearly |

| Additional fee to Credit Committee Member | 15 | Per attendance |

| Additional fee to Chairperson of Committee | 10 | Per attendance |

| Risk Committee Member being also a Credit Committee Member | 25 | Per attendance |

The Non-Executive Directors have not received any remuneration in the form of share options or bonuses associated with organisational performance during the year.

Total remuneration and benefits received and receivable, by the Directors from the Bank and its subsidiary for the year ended 30 June 2020 were as follows:

| YEAR ENDED 30 JUNE 2020 |

YEAR ENDED 30 JUNE 2019 |

YEAR ENDED 30 JUNE 2018 |

||||

|---|---|---|---|---|---|---|

| Executive Directors | Non-Executive Directors | Executive Directors | Non-Executive Directors | Executive Directors | Non-Executive Directors | |

| MUR' 000 | MUR' 000 | MUR' 000 | MUR' 000 | MUR' 000 | MUR' 000 | |

| The Bank AfrAsia Bank Limited |

20,272 | 21,444 | 17,975 | 13,454 | 17,546 | 13,946 |

| The Subsidiary AfrAsia Capital Management Limited |

2,325* | - | 12,225 | - | 5,629 | - |

*The Director was appointed as Executive Director on the 30th of January 2020.

The detailed fees/remuneration paid to Directors have been provided on page 46 of the Corporate Governance Report.

DIRECTORS’ SERVICE CONTRACTS WITH THE BANK AND ITS SUBSIDIARIES

Sanjiv Bhasin, Executive Director of AfrAsia Bank Limited, has a service contract with the Bank expiring on 30 June 2021.

Thierry Vallet, Director of AfrAsia Investments Limited, has a service contract with the Bank expiring in June 2021

DIRECTORS’ SHARE INTEREST